Offer in compromise: How to Get the IRS to Accept Your Offer - Law Offices of Daily, Montfort & Toups

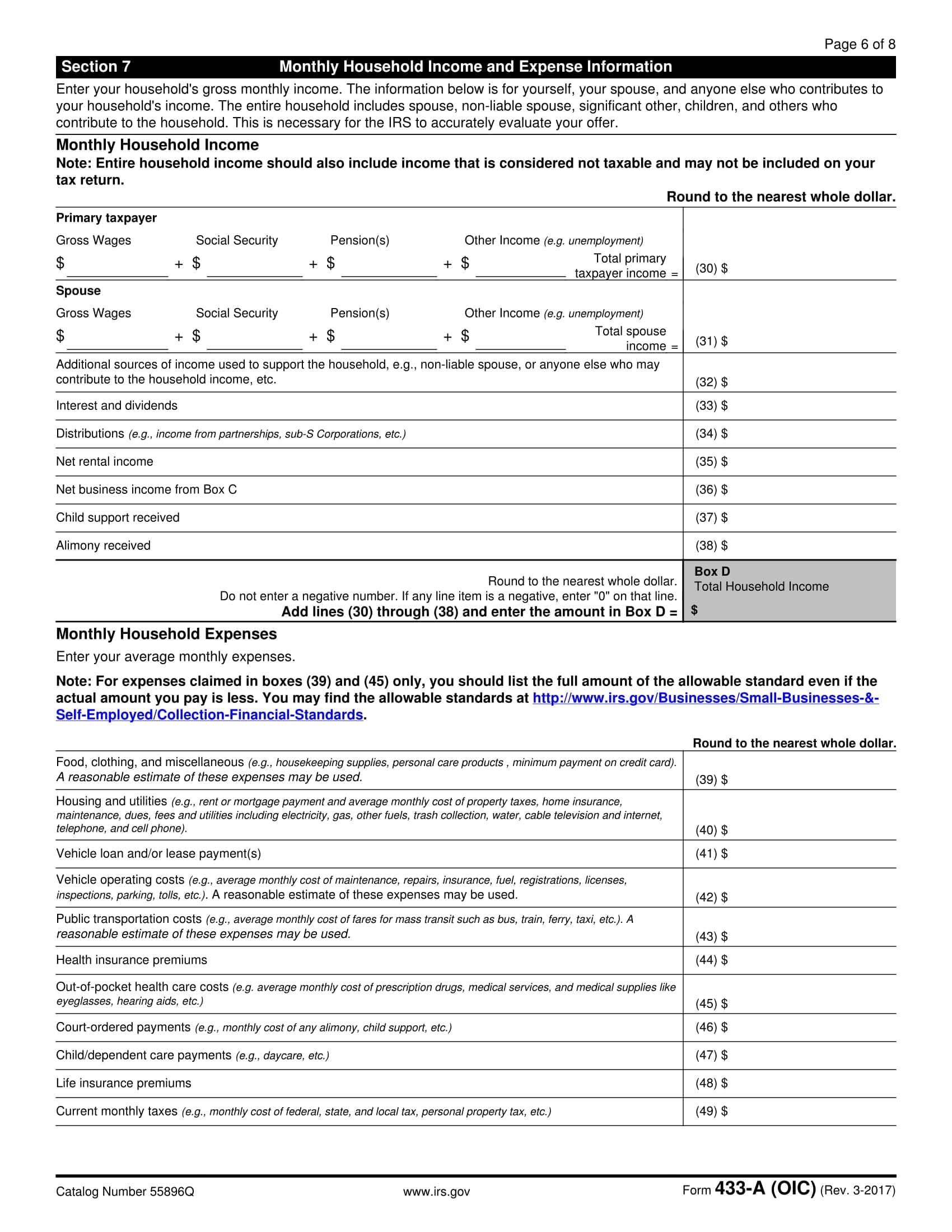

How much should you offer in compromise? It depends on a lot of factors. Learn more about Offer in Compromise amounts at Community Tax!

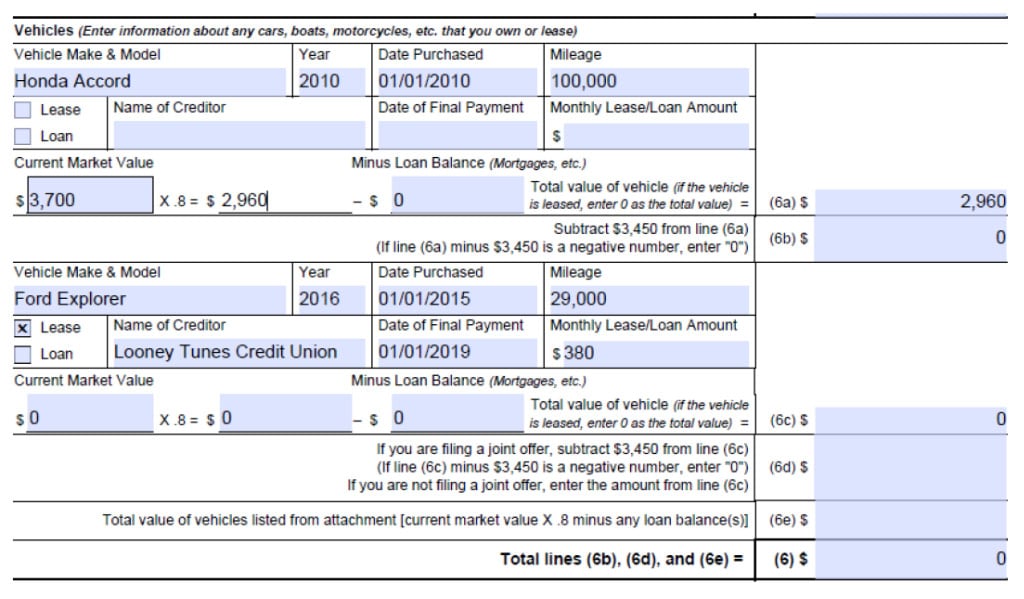

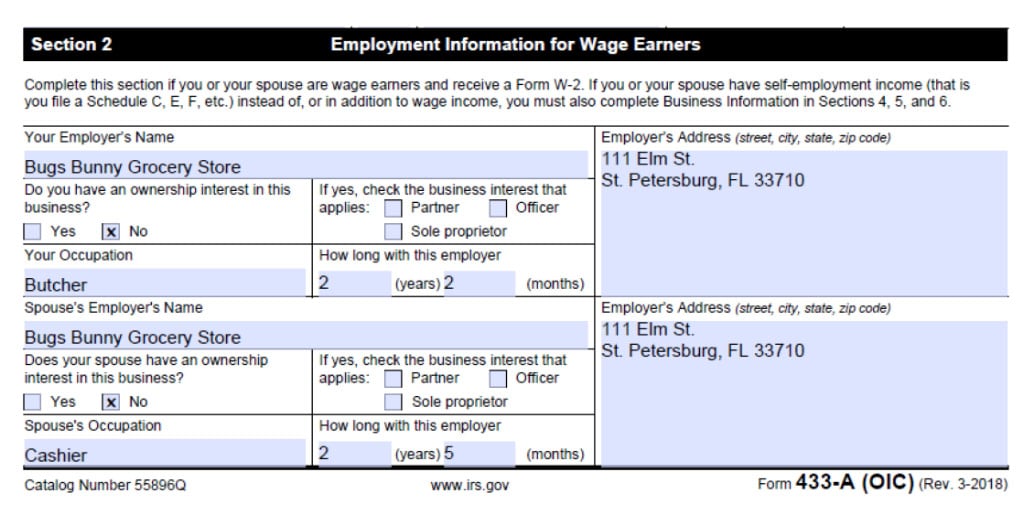

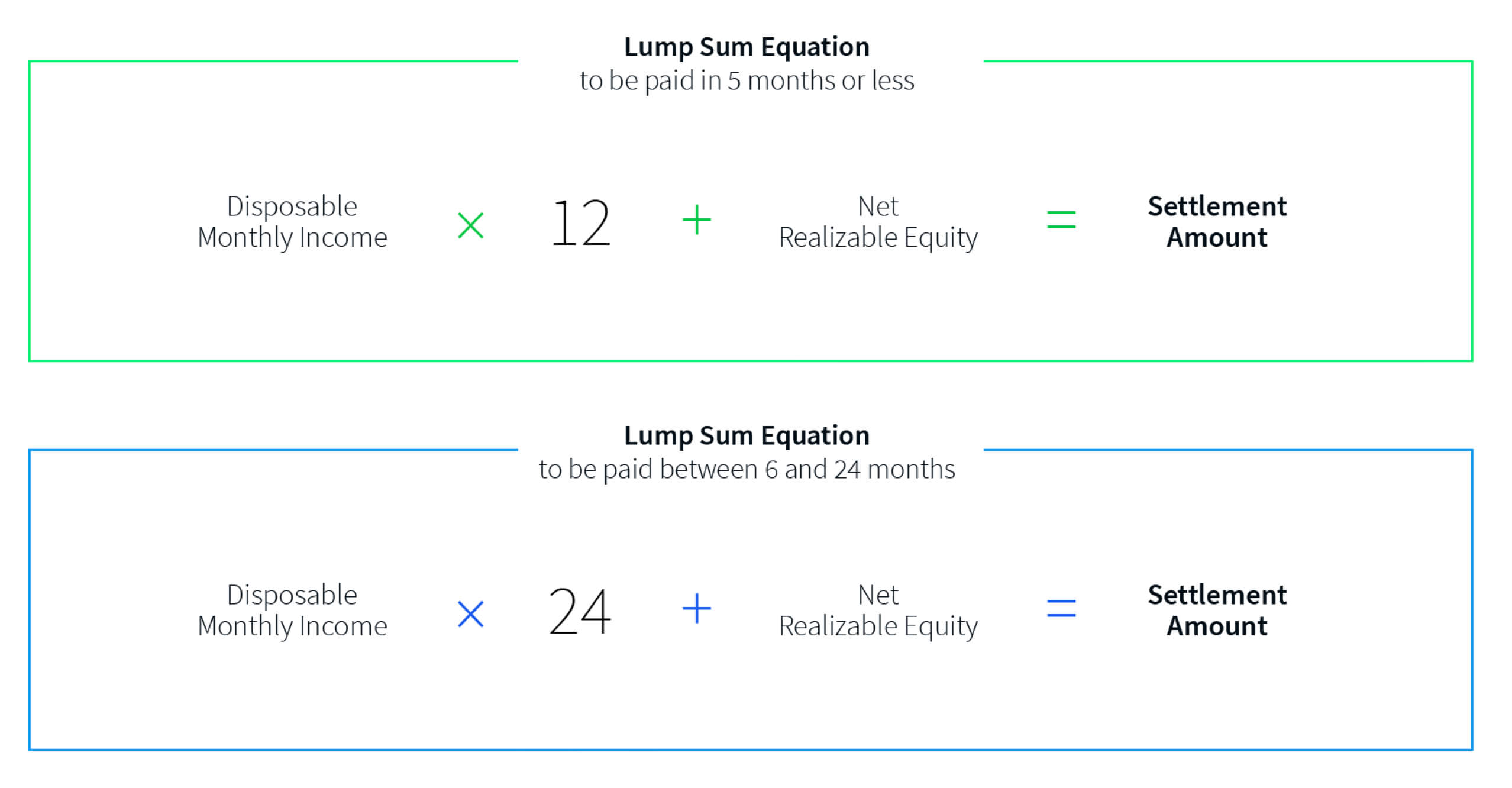

IRS Offer in Compromise Formula - How The IRS Calculates Tax Settlements | Tax Resolution Professionals, A Nationwide Tax Law Firm, (888) 515-4829

What is the Difference between the IRS Fresh Start Program and an Offer in Compromise? - Segal, Cohen & Landis, P.C.

Offer in compromise: How to Get the IRS to Accept Your Offer - Law Offices of Daily, Montfort & Toups

:max_bytes(150000):strip_icc()/GettyImages-81896696-576c273d5f9b585875675ceb.jpg)

![IRS Offer in Compromise [INFOGRAPHIC] 3 Reasons To Not Pay Taxes IRS Offer in Compromise [INFOGRAPHIC] 3 Reasons To Not Pay Taxes](https://help.taxreliefcenter.org/wp-content/uploads/2019/05/TRC-PIN-IRS-Offer-In-Compromise-_-What-Is-It-And-How-Can-It-Help-You.png)